CORUM Asset Management

Our unique expertise in Real Estate Management.

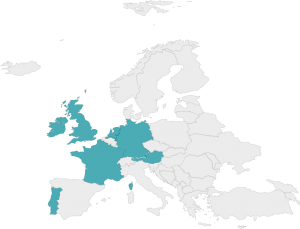

Since 2011, we have invested directly in more than 16 European countries. Our investment strategy is to use real estate cycles rather than being subjected to them, by identifying countries whose real estate assets remain undervalued.

We also manage all of these buildings directly, without an intermediary. Our asset management and property management teams serve more than 400 tenants.

Key Figures

Founded in 2011, CORUM Asset Management is a 100% independent asset management company, which manages more than 8 billion euro of real estate assets spread across several funds. CORUM Asset Management is authorized and regulated in France by the Autorité des Marchés Financiers (AMF – n ° GP11000012). CORUM Asset Management is the management company of the CORUM Origin, CORUM XL and CORUM EURION Real Estate Funds.

Contact Information

1 rue Euler – 75008 Paris, France

+ 33 1 88 88 18 81

Launched in 2012, CORUM Origin is the 1st SCPI to have invested in all the euro zone countries.

6.84 % Internal Rate of Return* (IRR) over 10 years

6 % Annual target return (non-guaranteed and net of subscription and management fees)

Launched in 2017, CORUM XL invests in both in the euro zone and beyond.

4.28 % Internal Rate of Return* (IRR) over 5 years

5 % Annual target return (non-guaranteed and net of subscription and management fees)

Launched in 2020, CORUM Eurion invests throughout the euro zone.

6.50 % OBJECTIVE Internal Rate of Return* (IRR) over 10 years (not guaranteed)

4.50 % Annual target return (non-guaranteed and net of subscription and management fees)

Launched in 2012, CORUM Origin is the 1st SCPI to have invested in all the euro zone countries.

6.84 % Internal Rate of Return* (IRR) over 10 years

6 % Annual target return (non-guaranteed and net of subscription and management fees).

CORUM USA takes you even further: your savings reach the United States.

4.50 % Internal Rate of Return* (IRR) over 10 years

4.50 % Annual target return objective (non-guaranteed and net of subscription and management fees).

Launched in 2017, CORUM XL invests in both in the euro zone and beyond.

4.28 % Internal Rate of Return* (IRR) over 5 years

5 % Annual target return (non-guaranteed and net of subscription and management fees).

Launched in 2020, CORUM Eurion invests throughout the euro zone.

6.50 % OBJECTIVE Internal Rate of Return* (IRR) over 10 years (not guaranteed)

4.50 % Annual target return (non-guaranteed and net of subscription and management fees).

*The internal rate of return (IRR) measures the profitability of an investment over a given period. It takes into account dividends distributed, changes in share value over the period, as well as subscription and management fees incurred by the investor. It also takes into account the fact that the value of money evolves over time: €1 today is worth more than €1 in 1 year’s time, as this euro can be immediately reinvested and grow.

Documents

QUERIES?

Error: Contact form not found.

Contact us directly